Legislation

|July 20, 2023

Legislative roundup — Pay-gap bill LD 1854 passes; progress made on retirement security

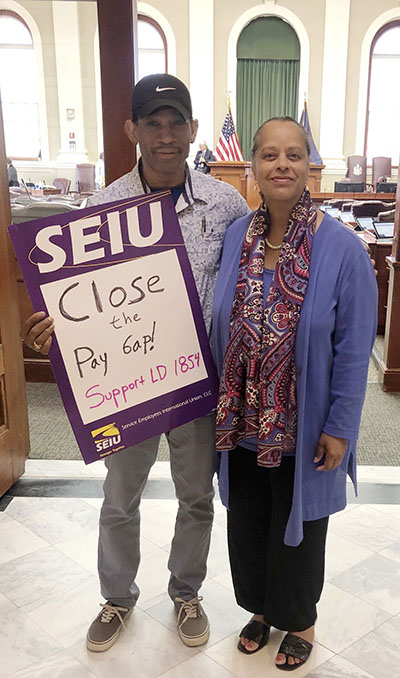

MSEA-SEIU Cumberland Chapter Member and Executive Branch Union Negotiations Team Member Luc Nya, who works as a behavioral health coordinator for Maine DHHS, at right, thanks Representative Drew Gattine for sponsoring the pay-gap bill LD 1854, and his State Representative, Lynn Copeland, for cosponsoring it.

The Maine Legislature has passed, and Governor Mills has signed into law, a supplemental state budget that funds several of our initiatives.

The pay-gap bill LD 1854: The supplemental budget provides the funding necessary to complete the current Executive Branch compensation and classification study by Jan. 31, 2024, and to require the State to perform a compensation study every four years and conduct a comprehensive classification review every 10 years. The proposed penalty of a 5% across-the-board pay raise for all state workers in the event the State fails to complete and implement the current study by July 1, 2024, was removed from LD 1854, making it all the more important that we hold management accountable for meeting the deadline, and that we support our Executive Branch bargaining team in the contract negotiations under way to close the pay gap. We still have proposals on wages and the classification study on the Executive Branch bargaining table.

Maine Maritime Academy: The supplemental budget funds an additional $2 million per year for Maine Maritime Academy’s operations budget. This is somewhat of a disappointment following the Education Committee’s recommendation that MMA receive an additional $5-8 million increase to its baseline to make up for the large funding disparity between it and Maine’s other public higher education systems. It will be important that we voice support for increasing MMA’s funding by continuing to return to the Legislature and argue for equitable funding. Nevertheless, we’re encouraged by this year’s increase, which is the Academy’s single biggest in recent years.

Retirement security: The Supplemental Budget strengthens retirement security in several ways:

- The budget includes funding to make the state-income tax exemption on Maine Public Employees Retirement System pensions closer to the exemption for Social Security payments. Currently the state income-tax exemption on MainePERS pensions is $30,000. The enacted budget raises the exemption to $35,000 – and eventually to $48,000. This change will benefit all current and future MainePERS participants.

- The budget includes $19.8 million for a one-time payment equivalent to a 3% retiree cost-of-living adjustment for eligible state retirees — providing a maximum benefit of $726 and an average benefit of $527. While we pushed for a fully funded retiree COLA, this ad-hoc payment is nonetheless appreciated. And to be sure, the normal retiree COLA process in state law remains in place; the Legislature respected that law and the retiree-COLA process. Our fight to scale back the LePage Pension Cuts of 2011 will continue.

- The budget funds LD 1522, which will help eligible older Mainers with their Medicare Part B premiums through the State’s Medicare Savings Program. It’s our understanding that LD 1522 could provide economic assistance to about 5,000 retired state employees.

- The budget provides funding so that workers in the Maine State Police Crime Lab and Computer Crimes Unit retroactively become eligible to retire after 25 years of service regardless of age. Our members in these units have been advocating for this change for many years; we appreciate the Legislature recognizing the stressful and traumatic work they do.

- The budget includes funding to address an injustice involving about 125 state employees and public school teachers who were given a choice, back in 2011 when the pension cuts were made, between having retiree health insurance or taking a 6 percent annual hit to their pensions. Some were penalized by up to 90% of their pensions as a result. Moving forward, these retired state workers and teachers will now incur an annual penalty of 2.25% on their pensions, rather than the 6% they have been subjected to since 2011. We’ve been advocating for this change for years; we appreciate that the budget funds a solution.

- The Appropriations Committee funded LD 483, An Act to Amend the Laws Governing Retirement Benefit Reductions for Certain Employees Currently Included in the 1998 Special Plan.

Other notable votes: The budget provides $25 million toward the paid family and medical leave (PFML) program, as well as $60 million in childcare investments. The PFML program will let workers take time off for the birth, adoption or foster care of a child, or to provide care for themselves or their loved ones. The childcare funding will raise pay for childcare workers and make more families eligible for Maine’s childcare affordability program. These investments will go a long way toward helping workers with families.

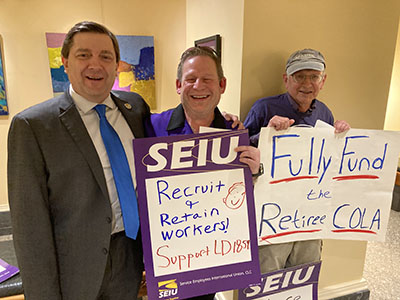

MSEA-SEIU Capitol Western Chapter President and Executive Branch Union Negotiations Team Member Kevin Russell thanks Maine House Speaker Rachel Talbot Ross for cosponsoring LD 1854, the compensation and classification study legislation.

MSEA-SEIU President Dean Staffieri, center, and MSEA-SEIU Retiree Member Rob Peale, at right, thank Maine Senate President Troy Jackson for cosponsoring LD 1854, the compensation and classification study legislation.